The Pathway

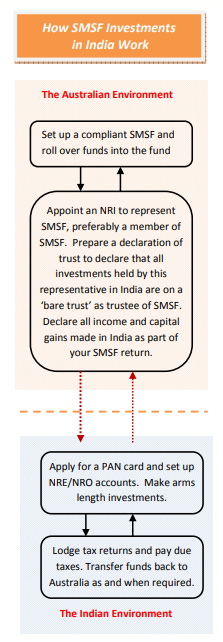

- An SMSF member with OCI represents the SMSF in India.

- Funds move directly between the SMSF’s Australian bank and the OCI rep’s NRE/NRO account.

- Investments are in direct shares or mutual funds in India, always at arm’s length and in the OCI rep’s name.

- Indian tax returns are lodged under the OCI rep’s name.

- Australian SMSF returns declare Indian income and capital gains, claiming foreign tax credits for Indian taxes paid.

- On asset sale in India, obtain tax clearance and remit proceeds directly to the SMSF’s Australian account.

The Advantage

- Growth: Access high-growth Indian markets with returns of 15–25% p.a.

- Familiarity: Invest where you understand the market.

- Costs: Benefit from lower advice and implementation costs.

The Risk

- Market Risk: High-growth opportunities come with greater market volatility.

- Currency Risk: Strong Indian returns can be offset by adverse currency movements.

- Costs: Overseas investments may mean higher accounting and audit fees.

The Quirks

- Invest in other countries? Yes—SIS law allows SMSF investments in listed securities across 180+ countries.

- Real estate overseas? Technically yes, but SMSF trustees must prove each year:

- Asset ownership for the SMSF

- Asset value as at 30 June

- All income and capital returns to the SMSF Australian auditors lack access to foreign registries, so you’ll need a licensed valuer each year—adding cost and complexity.